British Gambling Commission updates on progress of the Financial risk assessments pilot

Tuesday 11 de February 2025 / 12:00

2 minutos de lectura

(London).- The Gambling Commission has published an update on the ongoing pilot of financial risk assessments. Written by the Director of Major Policy Projects who is leading the pilot, Helen Rhodes, the update explores the early findings so far, now that the first phase of the pilot is complete.

Financial risk assessments are a proposed way of identifying high-spending remote gambling customers who may be in financial difficulties, in order to help support them. This is not the same as “affordability checks”: the Gambling Commission does not have any requirements for affordability checks and is not proposing any. Financial risk assessments would be a much more targeted way of identifying potentially financially vulnerable customers. They would not affect a customer’s credit score if they were introduced in the future.

Key points covered by the update are:

- The Commission is carefully piloting financial risk assessments to assess how they could be used to support financially vulnerable customers, before making final decisions on whether - and how - they could be introduced. The pilot is not in a live environment.

- More than 530,000 assessments across three credit reference agencies were conducted for approximately 300,000 accounts from a historical annual period in this first stage. This is not indicative of how many accounts might be assessed if the assessments were introduced in a live environment.

- Approximately 95 percent of assessments were matched in this stage – 92 percent for a full assessment and 3 percent as a “thin file” where there was no adverse information. This means a frictionless assessment was possible in these cases.

- Approximately 5 percent of these assessments were not matched in this stage – 4 percent because the customer could not be identified by the credit reference agency and 1 percent because of data issues, such as duplications or invalid fields provided by the gambling operators. A frictionless assessment was not possible in these cases.

- NatCen is working as our evaluation partner on this pilot.

The update emphasises that these findings are for Stage 1 only and comparisons should not yet be made to the estimates of the 2023 White Paper, which estimated 80 percent of accounts referred for an assessment would be matched, and 20 percent would not.

Director of Major Policy Projects, Helen Rhodes said: “The pilot exercise is proving to be worthwhile in testing how financial risk assessments might work in practice and explore practical implementation issues before final decisions are made. Taking a staged approach to the pilot means that issues identified in the first stage can be explored further, such as data consistency across credit reference agencies where appropriate and data accuracy from operators.

“A key part of our work will also be to further support operators to consider how financial risk assessments could be put together with other information about indicators of harm which the gambling businesses already have, to support customers in as frictionless a manner as possible.”

For more information please read the full Financial risk assessments pilot update.

Categoría:Others

Tags: Sin tags

País: United Kingdom

Región: EMEA

Event

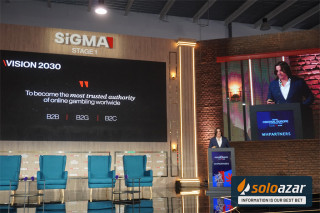

SiGMA Central Europe

03 de November 2025

SiGMA Central Europe 2025 Closes First Edition with High Attendance and Roman-Inspired Experiences

(Rome, Exclusive SoloAzar) - The first edition of SiGMA Central Europe in Rome came to a close, leaving a strong impression on the iGaming industry. With thousands of attendees, six pavilions brimming with innovation, and an atmosphere that paid homage to Roman history, the event combined spectacle, networking, and business opportunities. It also yielded key lessons for future editions.

Friday 07 Nov 2025 / 12:00

Innovation, Investment, and AI Take Center Stage on Day 3 of SiGMA Central Europe

(Rome, SoloAzar Exclusive).- November 6 marks the final and most dynamic day of SiGMA Central Europe 2025, with a packed agenda that blends cutting-edge tech, startup energy, and investor engagement. With exhibitions, conferences, and networking opportunities running throughout the day, Day 3 promises to close the event on a high note.

Thursday 06 Nov 2025 / 12:00

SiGMA Central Europe Awards 2025: BetConstruct Wins Innovative Sportsbook Solution of the Year

(Malta).- BetConstruct has been recognised at the SiGMA Central Europe Awards 2025, receiving the Innovative Sportsbook Solution of the Year award. This achievement highlights the company’s continued focus on elevating retail betting experiences and supporting operators with solutions that create measurable business value.

Wednesday 05 Nov 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.